Fraud Detector |

Use live data to pinpoint and prevent fraudulent claims

Why choose Fraud Detector?

Imagine if you could detect fraud, before it even becomes an issue. Fraud Detector does just that. It connects and analyses multiple sources of data points, from live industry and third-party data, in real time, to alert you to potentially fraudulent claims.

In short: if it’s fraudulent, we’ll help you stop it at the earliest possible stage.

What does Fraud Detector do?

Detecting fraud, in real time

Fraud Detector is powered by data. Lots of it. As a law firm that specialises in insurance, we have access to multiple sources of data points – from our own sources, from other insurers, and from the wider industry.

Kennedys IQ Platform, our AI ‘brain’, captures and analyses all of that information to look for potentially fraudulent claims. It verifies claimant data to build a detailed picture of the people involved and their connections. For example, it can spot whether people are putting in multiple claims – either with you, or across multiple insurers. Or it can even search for connections and relationships between people, both directly and indirectly linked to the claims. It can then help you determine whether claims are legitimate, based on the risk profile of your claims and your business.

And, if you use Portal Manager to manage claims Fraud Detector will provide real-time fraud risk assessment that is presented against each claim. So you’re more likely to spot potential fraud from the outset and throughout the

life of the claim.

Proactive learning

Fraud Detector augments human intelligence to create smarter rules. Our lawyers know about insurance and fraud, so they set the rules, then Fraud Detector challenges and verifies those rules. It can also look for patterns in the data that a human wouldn’t spot, which could lead to new rules. If the data suggests the rules are correct, Fraud Detector will flag it up to you. It’s a constant process of analysing and refining, to minimise your exposure to fraud.

How does Fraud Detector work?

Simply log in to IQ Platform, where you’ll see a live dashboard and get access to reports on current fraud issues.

Or, if you prefer, we can work with you to build Fraud Detector into existing workflow systems.

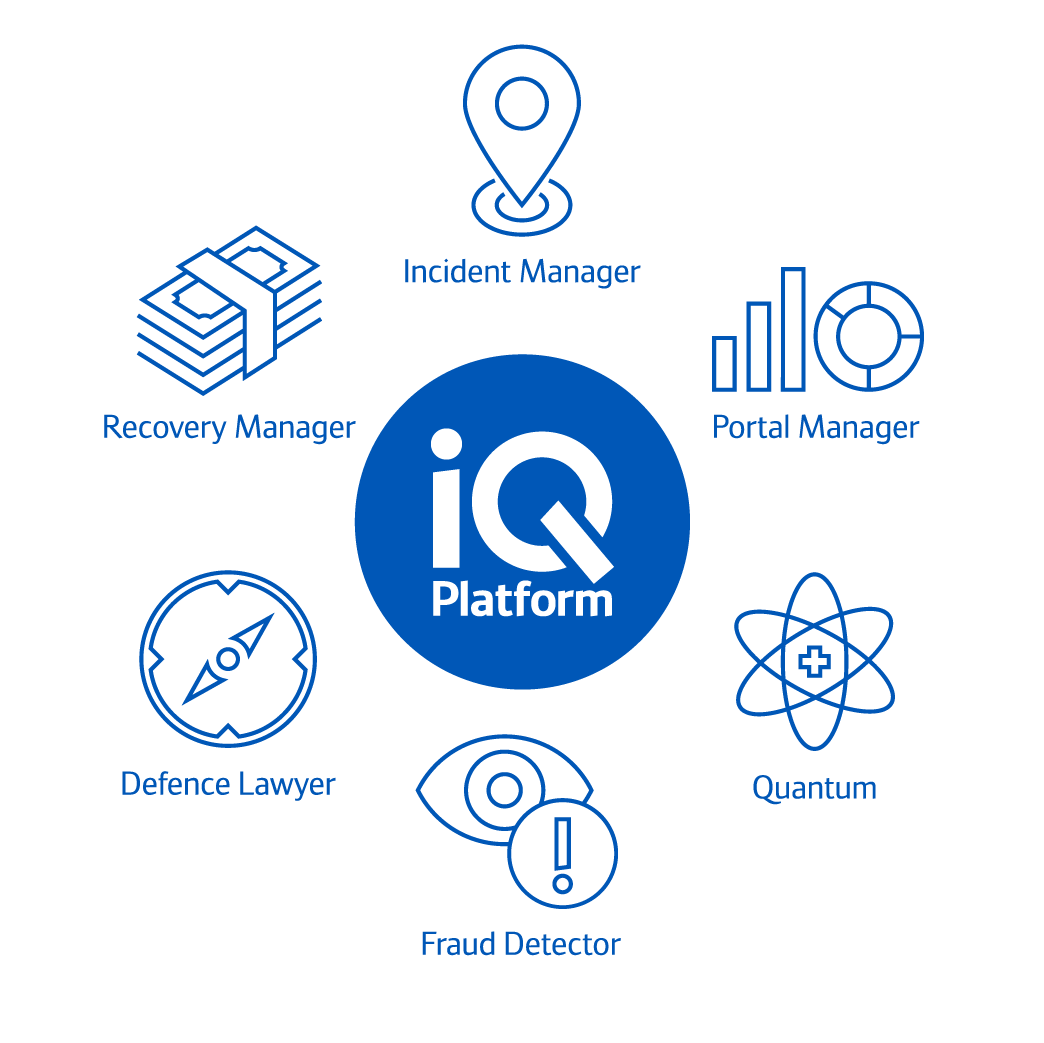

IQ Platform

Our AI and machine learning technology. One single platform with multiple features to support the claims process.

Portal Manager |

| Get a clear picture of what the MoJ portal can tell you about your business |

| Learn more |

Incident Manager |

| Create an immediate, accurate picture – with real-time incident support |

| Learn more |

Recovery Manager |

| Recover losses and get your money back, faster |

| Learn more |

Defence Lawyer |

| Manage the early stages of litigation, without lawyers |

| Learn more |

Fraud Detector |

| Use live data to pinpoint and prevent fraudulent claims |

| Learn more |

Quantum |

| Resolve disputes online. Quickly, confidentially, at a lower cost |

| Learn more |

Explore features of our IQ Platform

Incident Manager

Portal Manager

Quantum

Fraud Detector

Defence Lawyer

Defence Lawyer

Recovery Manager

Related news and insights

Kennedys IQ on using AI for ‘highly complex’ claims

Karim Derrick, chief products officer at Kennedys IQ, shares how the company is using artificial intelligence for complex claims documents.

Kennedys becomes first law firm to join prestigious US fintech research group

Kennedys IQ, through our global law firm Kennedys, has joined the prestigious US-based Center for Research toward Advancing Financial Technologies (CRAFT) as it cements its position as one of the world’s most innovative law firms.

Bright minds, brighter horizons: Kerala’s young innovators

Kennedys IQ’s Future Innovators programme saw students from a tribal school in Kerala develop innovative ideas for solving both local and global problems. In March, Kennedys concluded Innovation Month by inviting young students to share their ideas.