Enhancing claims reserving with SmartClaim |

Contacts: Simon Dean, Karim Derrick

Setting an appropriate reserve for insurance claims is a critical aspect of claims handling. While it’s common for claims handlers to establish a standard reserve based solely on the injury as described in the Claim Notification Form (CNF), there are additional factors to consider for a more accurate reserve assessment. In this article, we explore the significance of accurate reserves and the potential consequences of even a minor under-reserve.

The importance of accurate reserves

At Kennedys IQ, we emphasise the pivotal role of precise reserve calculations in successful claims management. A seemingly insignificant under-reserve of £1000 can lead to a staggering £5 million discrepancy across a portfolio of 5,000 pending claims. Considering the current high inflation rates and the anticipated 20% Judicial College Guidelines (JCG) update in January 2024, it becomes evident how easily claims can end up under-reserved.

In collaboration with Manchester University, we have developed SmartClaim, a sophisticated decision-making tool that significantly enhances the consistency and accuracy of decision-making within the claims process.

SmartClaim’s innovative approach

SmartClaim is meticulously crafted to empower claims professionals, functioning as a hybrid expert system that seamlessly integrates human expertise with the capacity to handle complex, non-linear relationships and navigate uncertain scenarios. This tool is enriched with expert rules and leverages cutting-edge techniques, including modern machine learning, data analytics, intelligent modelling, and decision support systems, to elevate the efficiency and precision of insurance claims processing.

SmartClaim’s impact on reserving

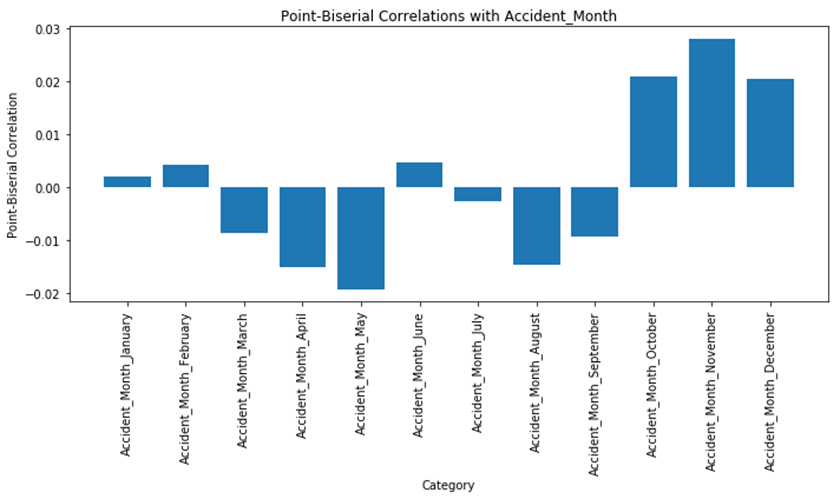

Kennedys IQ has conducted an extensive analysis of over 50,000 claims, scrutinizing all data points within the CNF to determine if they can collectively provide an accurate reserve for claims. While some data points, such as injury type, may appear obvious to directly influence final outcomes, the impact of factors like the accident month, age of claimant, and employment status on the ultimate claim resolution is less apparent.

Analysing each data point in isolation yields intriguing insights. For instance, when examining accident month’s correlation with claim outcomes, it is evident that claims from October, November, and December tend to settle at higher amounts compared to those occurring in March, April, and May.

However, the full picture emerges when we consider multiple data points simultaneously. For example, how does the correlation change if the accident occurred in October, there were mixed injuries, and the claimant is a minor? This is where SmartClaim’s technology excels; by employing evidential reasoning in conjunction with a belief rule-based approach, SmartClaim can comprehensively assess all data points and provide an accurate prediction based on CNF data. When combined with IQ Platform’s Fraud Detector solution, it enables the creation of an initial claims triage report for handlers before they even open the claim.

Ongoing reserving

SmartClaim is designed not just for setting initial reserves but also for refining them as anew information emerges during the claim’s lifecycle. This adaptability is crucial, especially when certain information is delayed indicating a potentially more serious claims than initially assessed.

Connect with us

Our team is dedicated to pioneering advanced technologies specifically designed to meet the unique challenges of the insurance industry. Take the first step towards transformation and reach out to our expert team at Kennedys IQ to explore how our innovative solutions can help you.

Related news and insights

Artificial Intelligence: exploring risks and rewards

Karim Derrick of Kennedys IQ explores the risks and rewards as the sector looks to an AI future.

Assessing the impact of the 17th Edition of the JCG on OIC Claims

The highly anticipated 17th Edition of the Judicial College Guidelines (JCG) has begun to reach recipients. Let’s delve into the standout updates from this edition and examine their potential implications for Official Injury Claim (OIC) claims.

Kennedys IQ on using AI for ‘highly complex’ claims

Karim Derrick, chief products officer at Kennedys IQ, shares how the company is using artificial intelligence for complex claims documents.

Kennedys IQ on using AI for ‘highly complex’ claims

Karim Derrick, chief products officer at Kennedys IQ, shares how the company is using artificial intelligence for complex claims documents.

Kennedys becomes first law firm to join prestigious US fintech research group

Kennedys IQ, through our global law firm Kennedys, has joined the prestigious US-based Center for Research toward Advancing Financial Technologies (CRAFT) as it cements its position as one of the world’s most innovative law firms.

Bright minds, brighter horizons: Kerala’s young innovators

Kennedys IQ’s Future Innovators programme saw students from a tribal school in Kerala develop innovative ideas for solving both local and global problems. In March, Kennedys concluded Innovation Month by inviting young students to share their ideas.